Dec 2022 US Inflation - My interpretation

Inflation numbers for Dec 2022 are released today (Jan 12)

- CPI reduced by 0.1% MOM and stood at 6.5% YOY compared to 7.1% in Nov 22

- Core CPI increased by 0.3% and stood at 5.7% YOY compared to 6% in Nov 22

- Real average hourly earnings for all employees increased 0.4 percent from November to December. This result stems from an increase of 0.3 percent in average hourly earnings combined with a decrease of 0.1 percent in the Consumer Price Index for All Urban Consumers

- Unemployment rate edged down to 3.5% in December

Before we get into details, here is short summary

- Overall numbers are in right direction, but not enough to celebrate yet (Devil in details).

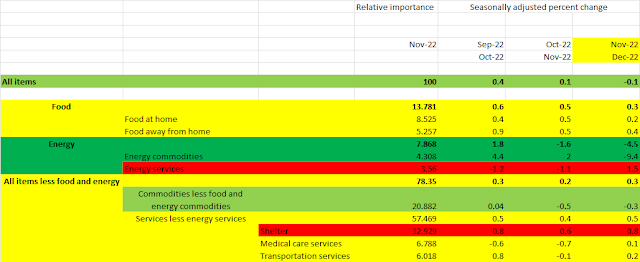

Let's get into details now. Here is the split of the numbers based on the category

Green rows represent drop in inflation

Yellow rows represent minor increase in inflation

Red rows represent major increase in inflation

- Inflation reduced primarily in the commodity category (both energy and non-energy). Within commodities, it primarily reduced in energy commodity (crude oil price reduced) and used cars/trucks.

- There are different global drivers for crude prices, and it doesn't give me a lot of reason to celebrate (except for few 10's of $ that I save on gas every month).

- Rest of the other categories have seen inflation increases ranging from little to large. Particularly shelter increased quite a bit and it increased for past 3 months which looks concerning.

- Significant increase in energy services could be a seasonal thing with heavy winters across many states past month. Not a lot worry about (Our home electricity bill doubled last month 😞)

- Food inflation is increasing as well despite drop in fuel prices.

- Core CPI and Services inflation are still increasing.

So, What's ahead?

- For the next 6 months, YOY inflation will be reducing due to the base effect (something to be careful while reading headlines). Refer to the below table.

- Still can't come below 2% (fed's target) in next 6 months for sure.

- Even after 6 months, not convinced that we will have a 2% inflation. My guess is 2.5 - 3.5.

- Rate hikes will be there for next 6 months. Magnitude might be small (0.25 - 0.5%)

- 0.3% MOM increase in wages (~3.6% YOY wage increase) along with reducing unemployment will not help in drastically reducing inflation

- Companies with tons of debt will have to pay more interest and will reduce the earnings.

- Debt free companies with solid cashflow will perform much better

Comments

Post a Comment